Retail traders often can’t understand why they don’t get no respect …

But most retail traders don’t even know the game they are actually playing.

Ima drop some knowledge on you today in simple and uncomplicated gratitude for putting up with my recent spamfest.

It’s a 3 part series so expect more of the good stuff over coming days and don’t forget to check your email tomorrow.

Here’s the deal.

There are two types of games.

Risk premia games and Alpha harvesting games.

Did you know that, anon?

Well, it’s literally IMPOSSIBLE to be any good without knowing it, so play close attention while I wash your brain out with soap.

Risk premia games are where you take on risk other people don’t want to take on.

You don’t really want to risk having your house burn down so you buy insurance.

You aren’t really trying to make a profit, just avoid the possibility of having the crappiest day ever.

So it’s reasonable to expect the insurance company to make a profit.

They are taking on risk that you’d rather not take on… and you are happy to pay them to take it.

It’s not a real difficult game for them.

It’s not difficult to understand, or model out… but its gonna have some crappy days.

You get a big ass fire that burns down a whole town, they are gonna take a cock-punch.

This is important to understand.

They get the risk premium FOR taking the pain.

Know this…

No👏premium👏no👏pain👏!!

Here’s how *I* think about it.

After eating too much taco bell you did a monster turd, a genuine double flusher…

Now your toilet is blocked and overflowing with nasty brown runny shit…

Do you want to get out the plunger yourself, or are you happy to pay some other poor schlub to come do that nasty task for you?

Of course you are. Probably happy to give him a tip as well.

Plumbing is analogous to risk premia games.

Taking on risk others don’t want, like a plumber.

You see this everywhere in life.

Value investing is buying companies below their fair value.

While everyone else is goggle-eyed at sexy growth stocks like Tesla and Amazon… it stands to reason that people will systematically overpay for the hot-girl stonks, and the boring old-man stocks will trade cheaper than they should.

Makes sense, right?

It’s risk, but other people don’t want it because it’s not sexy.

It *feels like shit* to be long General Electric and McDonalds while Tesla goes to the moon.

So there’s a long term PREMIUM for those with the testicular fortitude to stick it out.

Of course growth stocks have beaten value stocks for the last 20 years… but in the next 20 years I reckon you’ll see a comeback for the ages.

There’s a few of these different risk premia games we can play.

Carry trades are one of the strongest edges in all of finance.

Here’s a backtest of carry on the USD major FX pairs

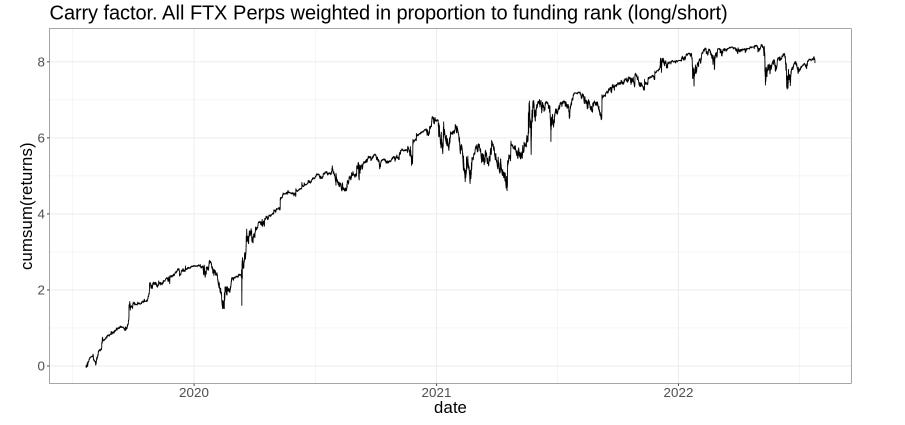

And here’s how it works on crypto

Looks incredible, right?

But not so fast, anon.

Carry tends to shit the bed at the exact time you’d really prefer it not to shit the bed.

Everybody hurts some… times… but it sucks most of all to be hurt when it hurts to be hurt.

When you could really use your cash to go buy some cheap coins or stonks.

Remember, no👏premium👏no👏pain👏!!

Carry is awesome and it sucks at the same time.

Carry is the basis of our Crypto Salary System BTW

(click the link to get in)

There’s one more type of risk premia game we can play.

And it’s the strongest one of all…

Trend, sometimes called Momentum.

It explains 61% of the total price movement of stocks over the last 100 years.

In fact, if you throw Trend, Value, Quality and Defense and into all the stocks that have ever been traded over the last 100 years…

They mathematically explain 95% of all stock returns.

The great mystery of why stonks go up and down (which we all try and solve by drawing lines on charts) is mostly solved now.

No shit!

So riddle me this.

If you can explain 95% of stock returns with these 4 “factors” (and this isn’t my crazy idea this is literally something with a Nobel Prize for finance backing it up)...

What is left for technical analysis to explain?

And why does tEcHnIcAl aNaLySiS work?

Well… technical analysis works to the extent that it recognizes those factors.

When you are buying a pullback in an uptrend you are buying momentum.

When you are buying a breakout you are buying momentum.

MOST of the technical analysis that’s not bullshit is based on “the trend is your friend”.

But we aren’t in the pre-computer ages anymore so you can put a number on it.

Which is what I do with our trend system. Which you get with the Crypto Salary System

But not so fast,

No👏premium👏no👏pain👏!!

So why does trend suck?

Well, it has a very LOW win rate.

And you are holding out for the biggest 10 bagger and 100 bagger wins… so you might be waiting a looong while.

You can kinda mitigate this by taking many swings at bat, but still… trend sucks.

When I was trading trend manually, every year I had stretches of 14 or more losing trades IN A ROW.

Retail traders lose because they think “this has stopped working” and switch up, just before it comes good.

Basically, unless you have balls like mine you aren’t gonna be able to do this, UNLESS you have a computer do it for you.

Of course, I’ve built an algorithm to do it all without you having to know a thing or do a thing… and it comes with the Crypto Salary System because they work powerfully together…

Like Batman and Robin (but less gay)…

Like hookers and blow…

Trend and Carry are best friends forever

So, let's summarize.

Risk premia games are taking on risk other people don’t want.

The strongest risk premia with the most evidence are Trend, Value, and Carry.

Crypto valuations are boo-sheet, so we can’t go there… but it’s no accident I based our two systems on the two strongest risk premia.

When one shits the bed the other will still probably work. (remember, no👏premium👏no👏pain👏!!)

If you want to join us.. Click here.

Now, tomorrow we move onto the OTHER type of games.

Alpha games.

Scott