Yesterday I blathered on at length about the first type of trading game you can play.

The easiest type of game to play are RISK PREMIA games and if you missed it you can read about it here.

There is nothin-for-nothin in this life and risk premia games are easier, safer, but not nearly as profitable as some other games.

There’s a second type of trading game we can play.

They are harder but more profitable, and they don’t last forever.

Other people are trying to get the same bread as you.

So they suck as well, just in a different way.

So let’s dive deep today on Alpha Games.

What is alpha?

Alpha is when you figure out a price inefficiency.

To generate alpha you have to know something the rest of the market doesn’t know, that’s it’s underpriced or overpriced.

Maybe the squiggles you drew on your chart lead you to believe the market has gotten price discovery wrong (unlikely but it can happen)

Maybe you notice that a price insensitive seller has pushed the price of a coin lower on gate.io exchange than binance.

You can earn alpha by helping to nudge that price back into proper alignment.

And this is how I’d like you to think about it.

Trading edge IS service.

Ask yourself “what useful thing am I doing for the market that someone’s gonna pay me for?”

Some examples…

1) A coin is trading at a lower price on one exchange than another because somebody got rekt.

You can be useful by buying that coin and helping nudge the market back into place.

2) Degens aped into a small cap shitcoin, sending it to the moon. You can short that coin and help it come back to it’s fair value of 4/5ths of fuck-all.

3) You have some data on-chain that predicts price. Since on-chain is the “fundamentals” (and yes I’m aware of how retarded I am using the word fundamentals about crypto) price discovery has diverged from fundamentals and you can be a good chap and help the market find equilibrium again.

4) You notice (this was a real one) that FTX had a token called SHIT-PERP (no shit it did). That token was an index of other tokens, and they “rebalanced” at 00:02 UTC time every day. With a spreadsheet you can work out how much of each coin FTX will have to go into the market and buy or sell, and get in a minute a head of them and help nudge the market back to it’s fair value. This was literally how Alameda research set fire to 10 billion dollars. That money didn’t go into the ether… it went to the smarties on the other side of that trade!

So Alpha is really doing something clever. Knowing something the market doesn’t.

One evergreen source of alpha is PRICE INSENSITIVE traders… rebalancing ETF’s or tokenized assets, or traders getting liquidated, or traders who are tax loss harvesting, or end-of-month window dressing.

You can see this is hard… but you might not fully appreciate WHY this is so hard.

There is a bar on your street.

On Sunday morning after a rowdy Saturday night you see a $20 note on the ground.

Woo Hoo!

It’s obvious what’s happened. Some drunk muppet has reached in his pocket for his phone and dislodged a $20.

Breakfast is on him!

Now, here’s where it gets interesting.

You go back NEXT Sunday.

Same deal. Another $20.

This time you brag to your mates about it at your local.

And the next Sunday, you arrive and see one of the guys you told walking away, happy as a clam.

You call out to him “hey mate, that’s MINE!”

He turns around and laughs.

Money ain’t got not owners, only spenders, brah.

Well that sucks.

There was an INEFFICIENCY, and it’s now closed.

No point in you turning up to get it now, it’s already going to be gone.

If you arrive at 5am, your mate will get there next week at 4am, and so on and so on.

Let’s look at how this works in trading.

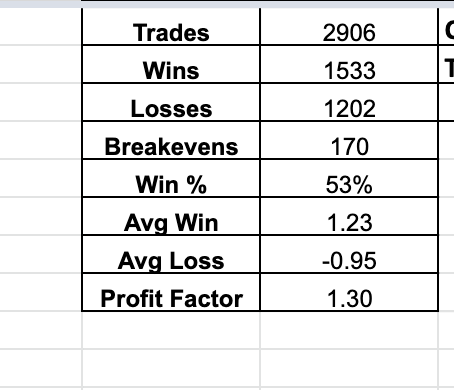

Here’s my real world results for the Holy Grail Scalping System on EURUSD for 3000 trades or so.

Looks amaze-balls, right?

It’s pure alpha, btw.

So here’s the deal. If enough people start trading this, the edge will decay.

How many people?

With ONE tick of slippage on EURUSD the edge decays from .25 expectancy ($250 per trade on average risking $1000/trade) to .11 expectancy ($110/trade).

With TWO ticks of slippage it falls away to about breakeven.

Now, EURUSD is the deepest most liquid market in the world, but not all the time.

And even in NYSE market hours 30 million on the bid will give slippage.

So if the total people trading this system bet more than 30 million this edge will disappear.

You want painful truth or comforting lies?

So those risk premia games we talked about yesterday are extremely high capacity.

It’s hard for them to disappear.

People have known about them for 100 years and they still work just fine.

Alpha is a $20 note dropped outside a crowded bar.

Risk premia is a $20 note dropped in the middle of a freeway.

Which do you think is gonna be around longest before it’s picked up?

It’s my opinion that since Alpha is so hard, and people can literally steal yours… that you should base your trading business on risk premia FIRST.

Treat Alpha like icing on the cake.

Which is why the Crypto Salary System is based on Carry (strong risk premia) with a little bit of alpha (mean reversion) as icing on the cake.

And the trend system isn’t even that clever. It’s just monetizing a type of risk that other traders don’t want to take.

Everyone KNOWS that if you bought 1000 shitty altcoins, you’d have enough moon to pay for the rest.

That’s not controversial.

But the reality of that would SUCK.

You’d have to take hundreds and hundreds of 99% losses to get that one big win.

It would break your heart.

So our trend system does that (smarter, obviously), and fully automated.

Can you see how it’s just taking on risk other people don’t want to take on?

Easy games are… easy.

They make winning CERTAIN and not a matter of luck.

So if you want both those elegantly designed and supremely capable systems for yourself….

Scott